While showing some very preliminary graphs to the people in #bitcoin-assets, one of them mentioned I should apply some analysis to the betting website just-dice. (See here for discussion)

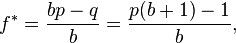

The proper place for prospective betters with a quantitative bent is generally to start with the Kelly Criterion, described by Wikipedia as follows:

- In probability theory and intertemporal portfolio choice, the Kelly criterion, Kelly strategy, Kelly formula, or Kelly bet, is a formula used to determine the optimal size of a series of bets. In most gambling scenarios, and some investing scenarios under some simplifying assumptions, the Kelly strategy will do better than any essentially different strategy in the long run (that is, over a span of time in which the observed fraction of bets that are successful equals the probability that any given bet will be successful). It was described by J. L. Kelly, Jr in 1956.[1] The practical use of the formula has been demonstrated.[2][3][4]

Where

p = Probability of winning

b = Net profit from a winning bet

Wikipedia also notes that if the equation returns a zero value the optimal bet is no bet and if a negative value is obtained then the prospective better should (if possible) take the other side of the bet.

Unfortunately this option isn't available for the just-dice website (making it more of a game than risk market) so before analysis even begins we already know just-dice is potentially not a good place to place bets (note on this at the end).

But let's push on and see what kind of numbers we get for the various values of p and b. This is a crude sensitivity analysis just to see if the data tells any obvious stories, the just-dice site should be commended for making a very nice betting site which is quite transparent in terms of showing you the parameters of each bet.

The analysis shows that there isn't much point pressing deeper into the data as it's doubtful we will see a positive f* value and as I mentioned earlier we cannot take the other side of these bets in the game.

Note: One cool thing about just-dice is that they allow you to "invest" in the house, i.e. your bitcoins get exposure to the house edge (according to their website, currently limited at 0.5% of the total 1% if my reading is correct).

The sensitivity analysis shows that for the chosen (and likely all possible) probabilities, the optimal bet is to take the house side of the bet, so the only optimal bet is to invest. Anyone playing the game should view it as a crapshoot or hobby at best.

The topic of when to invest in just-dice and when to withdraw is obviously an interesting one of itself and might form the topic of a later blog post, leave a comment if you'd be interested.

It took me about 1.5 hours to sail about the just-dice website, collate data and write this blog post. If you found it interesting and would like to encourage more postings of similar stuff, consider a 1.5h*BTC donation to

1CcaDNd7mso6PcCHLitZXGeRNdrCJrgx7u

No comments:

Post a Comment